Family well being is a wealthcare essential

“The family is the foundational unit/building block in a society. The functional family, as a team, symbolizes the ideal of human interdependence: It has long provided a firm foundation for society. The healthy family is an embryo of society and the native soil in which ethical values take root and grow. Fertilize this soil, and the whole of society benefits.”

I Ching 37

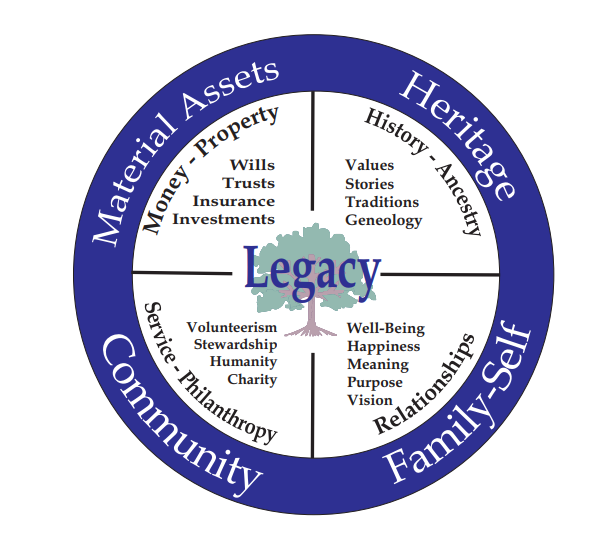

Families, as they navigate the inevitable circle of life will encounter challenging times. Events such as the death or incapacity of an elder family member can be particularly stressful. Upheaval and chaos often result as family members adjust to their new reality. How a family deals with these disruptive events reflects their cohesiveness, resilience and strength as a family– i.e., their level of “family well-being.”

Within most families there will be varying degrees of emphasis on the creation and preservation of wealth, sometimes referred to as “WealthCare.” The degree of emphasis will most probably be in direct proportion to the level of wealth within the family. Advisors in the financial, trust and estates industries have a large stake in helping families care for their material wealth, and obviously the larger a family’s net worth, the greater the efforts of the advisors.

Unfortunately advisors seeking to help families manage, protect and transfer wealth between generations are not trained to deal with and often overlook (ignore) family relationship dynamics, (i.e., well-being), and history has shown how the absence of well-being within a family poses a significant threat to the multi-generational preservation of a family’s wealth.

A recent survey conducted among 3,250 affluent, entrepreneurial families (having family wealth ranging from $1 Million to $1 Billion) found only 30% of the attempts at inter-generational transfers of family wealth were successful: 70% of the wealth transitions had failed – “failure” being defined as outcomes the families had sought to avoid, i.e., intra-family conflict, damaged lives and relationships, loss of family wealth, failure or loss of a successful family-owned business, etc.

The survey also revealed how 85% of the wealth-transition plan failures were directly related to dynamics within a family: more specifically, “a lack of communication and trust between family members” and “inadequate preparation of heirs” (i.e., the absence of family well-being).

Values

Human values can be viewed as a driving force that affects/controls every aspect of a persons’ behavior, thoughts, beliefs, communication and world view. Values are the priorities one is motivated to act upon. Research has now identified and defined 125 human values that have the potential to appear in the life-long growth and development of an individual; however, the same research has determined that the majority (roughly 80%) of the values that control a person’s (or a group’s) behavior, world view, etc. operate below the level of conscious thought.

There is a consensus emerging in the professional community that points to human values as the root cause of the wealth-transfer failures within a family. However, until recently there has not been a reliable way to thoroughly assess and understand how values operate within an individual or a group.

The “lack of communication and trust between family members” (and the resultant failure to prepare junior family members to become wealthy) in most cases can be directly linked to “values conflicts” between family members or values conflicts between one or more family members and the family group. As long as these intra-family values conflicts go unrecognized and unresolved, no amount of spiritual, financial, tax or estate planning can prevent the probable failure of a family’s inter-generational wealth-transition planning and the deterioration, if not the outright destruction, of relationships between family members.

Hall-Tonna Values Framework

The Hall-Tonna Values Framework and associated technologies, the result of over 30 years of research and development by the late Dr. Brian P, Hall and Benjamin Tonna, have been used extensively in the corporate world to evaluate the “fit” between proposed merger partners, in hiring employees and in the transformation of the culture within an organization. In the hands of a certified coach, Hall-Tonna technologies can identify and assess the relative priorities of the values operating in a person’s life, and to gauge the development of a group’s values. Using this technology, values conflicts between family members (and between the family group and its members) can be identified, and brought to a level of conscious understanding. With this knowledge in hand, communications and trust between family members can be improved and family well-being significantly enhanced.

Family well being is a WealthCare essential